Menu

Everybody has a Money Story. What’s Yours?

It’s highly likely that you’ll experience at least one life-changing event during your life such as:

-Divorce

-Inheritance

-Retirement

-Loss of Spouse

-Sale of Business

-Loss of Parents

-Serious Illness

-Lottery

-Relocation

-Job Loss

-Major Career Change

-Insurance Settlement

-Military Service

-Entertainment or Sports Contracts

These events happen as a result of a decision by the individual (e.g., personal reinvention, the sale of a business and often retirement), or are thrust upon the individual (e.g., inheritance, job loss, and often divorce). Either way, they are major life changes.

You can’t control all life events, but you can manage how you respond to them. The long-term impacts can be directed to a successful outcome if you’re willing to examine the uncertainties and consider the unknowns. Planning and preparing for change will help you manage the transition in a meaningful way. Whether events are celebrated or regretted, they shouldn’t be unexpected.

Change provides an opportunity for personal reflection, growth and learning. A healthy mindset about transition will foster resilience and manage stress. Proactive strategies set the stage for positive growth toward a deeper sense of self.

Do You Have A Healthy Relationship with Money?

Your mindset determines your success with money. Let’s find out where you are now.

When a major life change occurs, often people rush to make decisions. A comprehensive financial plan is created by an educated wealth advisor who acts in what is perceived as the client’s best interest. The advisor takes into consideration goals, risk tolerance, timelines, taxes and more. Instead of implementing a quickly thrown together plan, a timeout or breather may be the most prudent course of action. It’s often best to wait before making any decisions that will change the current course.

Transitions are important pivot points. That outcome depends on the individual, how you respond to the change, the type of support you have during that time, and the choices you make. A well known psychologist in “Change”, William Bridges in his book, In Transition: Making Sense of Life’s Transition wrote, “Though there are difficult changes to be made as one gets used to a new situation, the difficulty comes not from these changes but from the larger process of letting go of the person you used to be and then finding the new person you have to become in the new situation. The real difficulties, in short, come from the transition process.”

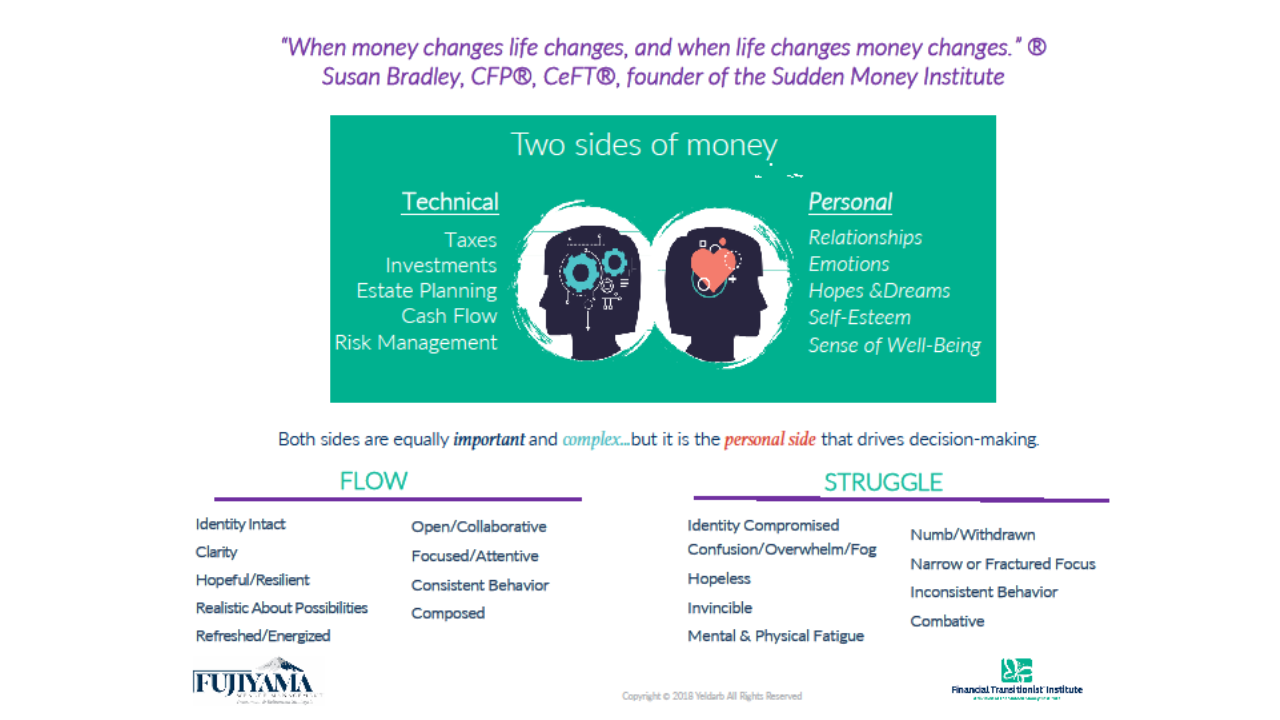

Notice that all of the difficulties with what Bridges calls “The transition process” (e.g., emotions such as guilt, decision-making, relationships) as well as the potential high points (e.g., a stronger sense of meaning or a new direction) have something in common. All of them fit squarely within the personal side of money.

There are Two Sides of Money – Technical and Personal

Both sides are equally important and complex… but it’s the personal side that drives decision-making.

We, Certified Financial Transitionist (CeFT) talk about co-creating the highest outcomes with you:

- Co-Creating – We drive the conversation while you steer the course, it’s your future we’re securing together.

- With You – not for you

- Our Clients (That’s YOU!) – the people & their lives – not the money

Certified Financial Transitionist Institute also addresses that there are Four Stages of Transition in life. Find out more about these four stages >

Ready to get started?

Step 1

Join our email list for financial tips

Secure your spot to receive tips and ideas to make your life transitions easier.

Step 2

Take our transition assessment

Take the Financial Transition Assessment to get a clear picture of where you are today.