Menu

Our Mission

We empower you to obtain the financial confidence and resources you need to take control of your money and wealth. Many of our clients engage with us when they are facing a major financial transition. Financial transitions that may lead you to seek our guidance include major life changing events such as divorce, losing a spouse, retirement, getting an inheritance or selling your business. Our goal is to help you navigate the long-term impact these events have on your life and finances. We help our clients make smart decisions today that lead to a better quality of life in their future. We are here for you.

As a Certified Financial Transitionist, I am uniquely trained to help both women and men who go through life changes such as:

- going from the workforce to retirement

- losing a spouse and feeling an identity loss

- suddenly becoming single and being forced to manage investments and finances

- acquiring an inheritance which comes along with more complicated planning needs

- selling a business with necessary changes in retirement and estate plans

- winning a lottery

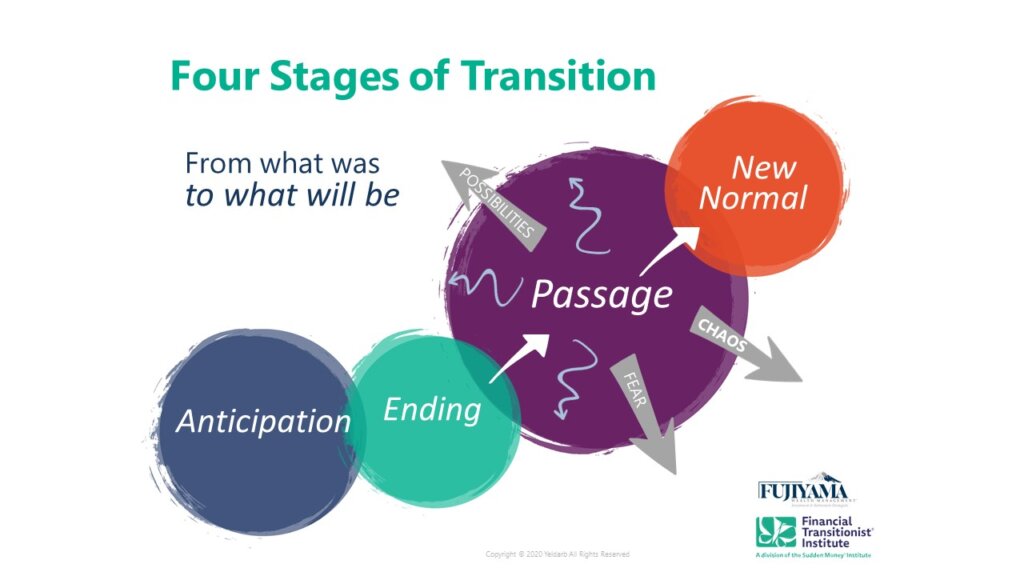

I am also trained to address the Four Stages of Transition in life as Certified Financial Transitionist.

There are Four Stages of Transition in life. Which stage of transition are you in now?

Stage One: Anticipation

Stage One: Anticipation

Stage Two: Ending

Stage Three: Passage

Stage Four: New Normal

In life you go through the above stages of transition, which creates Your Money Story. What’s Your Money Story?

Your Money Story began before you were in kindergarten, and probably influences your money behaviors, expectations, and decisions to this day.

It was formed by direct and indirect messages you received from your family, relatives, and community. These messages helped formulate how your family talked about money, how they got it, and how they spent it.

Your neighborhood, church, synagogue, peers, and the media also had messages for you about money, whether or not you were aware of it.

All of those messages created your mindset about money when you were a child. And that informed Your Money Story, which is literally the narrative you tell about the place of money in your life when you were growing up. You may or may not still have the same mindset; that’s what this experience is about. We are going to examine your past and present mindsets and whether or not they are positively influencing your behavior. If your relationship with money could use some improvement, this growth mindset experience will demonstrate that there are actions you can take starting right now, to better that relationship.